“Ich habe Pläne große Pläne” – Rammstein, Stein um Stein

No no, wrong take on “gross” – this is definitely not about making an obscene amount of profit… I’m writing about “gross profit” as in “GP” – a term often heard when industry folk are talking about beer prices. I have written about GP before, with a focus on the role of the distributor in pricing – in this post I focus more on the pub and the beer. The motivation comes from recently having had £4.50 pints of Beavertown Gamma Ray being compared to £3.00 pints of £60-per-firkin bitter as if the Beavertown ought to be closer to the £3.00. As it stands £4.50 for a pint of Gamma Ray is near unheard of as that is pretty heavily discounted for promotional purposes.

GP is the “gross profit” made on goods sold. That is the margin made by the business in ex-VAT terms. If I sell pints of beer for a bargain £3.20 per pint I have a revenue of£2.67 per pint once the 20% VAT is scraped off. If that pint comes from a cask that costs me £60 (about normal for a local “boring brown bitter”) then each pint is costing me 86p (assuming a 70 pint yield per cask). So my gross profit on a pint is about £1.81… typically GP is expressed as percentage – this is the percentage the gross profit is of the revenue and in this case is 67.9%. This would be considered “pretty healthy” by most pubs.

When pubs talk GP they’re generally speaking of the average for the beer they sell. They’ll be targeting some specific figure that suits their overall business plan. This can be anything from as low as 40% in a countryside tied pub that probably survives only on profits from non-drinks sales to 70% in a city-slicker freehouse which might get away with being pretty much “wet-led” (most income is based on drinks). Two extremes of the pub spectrum.

All business situations are different – tie, location, rent, staff costs, etc. There’s a good breakdown of the costs of running various sorts of pubs available from the BBPA. There isn’t a one-size-fits all when it comes to GP. Yet customer expectations set a pretty narrow band for acceptable pricing of a pint, a trend now being a little broken out of by the “craft beer” scene. Still – a tied pub next door to a freehouse can hardly sell equivalent beer for a quid more per pint than the freehouse… so it typically makes a significantly lower GP on beer.

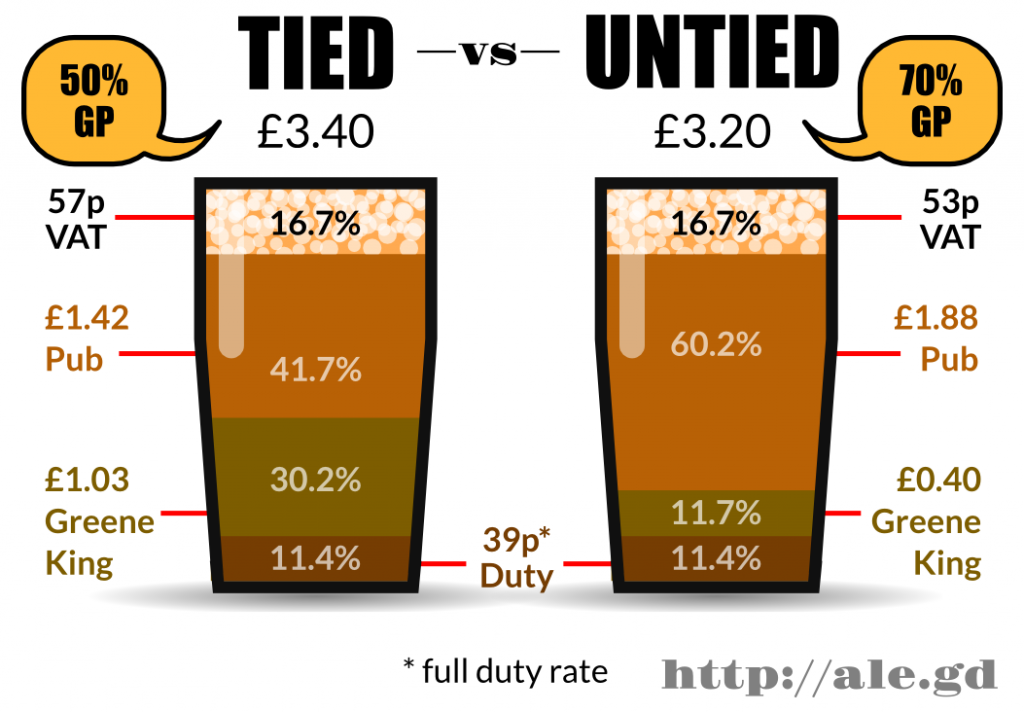

Let us look at a well known brown bitter as an example, a “20th century IPA” style of thing at about 3.6%. I’m talking about Greene King IPA of course. This is available on the open market at pretty low prices, I’ve heard of pricing as low as £55 from one reliable source. Meanwhile I know one Greene King landlord who pays £99. These prices are all ex-VAT, as is the way of these things. The problem is both pubs have to sell this beer for about the same price… in Cambridge let us say this is £3.20 in the freehouse and £3.40 in the Greene King place. The Greene King place isn’t going over the top on the price and there are plenty of drinkers in Cambridge who won’t be at all fussed by 20p if the pub is otherwise pretty good.

The freehouse GP here is a very healthy 70.5%… but the poor old Greene King pub is only at 50%. Keep in mind that these are pretty much extremes and there is a range between them, and then things differ again per beer and per pub.

The GP as a % versus “margin” in £ is important because punters generally only go out with so much £ in their pocket. Most people are living within a finite budget when it comes to luxuries like having a pint. The freehouse is making more per average customer. If the tied pub want to achieve similar profits it has to sell more volume (be larger, be in a better location) and/or shift other products – i.e. turn into a gastropub. Or maybe it can get by just fine as a wet-led pub simply making less profit… like I said before, every business situation is unique.

So that’s GP – and GP compared for tied and untied pubs. Now I get to the next core point of this blog-post: what does this mean for “craft beer” and why does my pint of Beavertown Gamma Ray cost me six bloody quid?!

Great tasty beer costs more. I won’t try to explain why – there are plenty of debates about how reasonably, or not, it is priced. All I’ll say is the brewers I know brewing what I think of as awesome craft beer are mostly working at capacity and expanding. Textbook supply-vs-demand means they can command a higher price for their product – within reason. Flavour is a factor, ingredients, and quality – but big factors are also fashion and brand… the best have all of these right. These folk haven’t founded a brewery with the aim of competing in the lowest-common-denominator end of the market. If this craft beer also happens to be in keg it’ll cost even more per pint, another debate to be had (and has been had) elsewhere.

In my opinion Beavertown stuff is reasonably priced, in the grand scheme of mid-5%s kegged craft beers. A pub will be typically paying anything between £85 and £100 for 30 litres of this lush 5.4% beer – depending on location, volume, and supply chain. For some calculations below we’ll pick £95 for a 1-off keg purchase in a very craft-keg-rotation-happy bar. This is to compare to the same bar buying any one of a dozen mid-3%s local bitters at £60 for a firkin.

We’ll say you get 52 pints out of a Gamma Ray keg, so a pint is costing £1.83 – more even than the pint of *tied* Greene King IPA (£1.42). But at £6 per pint the GP the pub is making on this beer is 63.5%. Most freehouse crafty places I know are aiming for the 65-70% GP range. They’ll cut a bit from target GP selling Gamma Ray at around £6 but balance this out by selling a “craft lager” at £4.50-£5.00 and higher GP (in the 70-75% range).

But, the punter says, a 70% GP pub selling a 3.6% 20th-century-IPA (brown bitter) is only making £1.88 from my pint – but this craft beer bar is making £3.18 from my 5.4% new-wave IPA… the profiteering SCUM! Fuck’em!

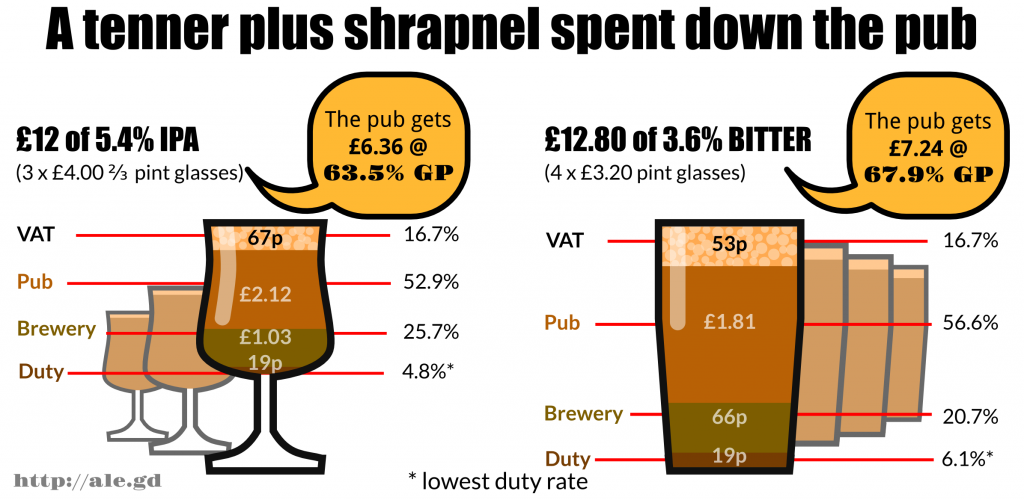

It doesn’t work like that. Going back to my point of punters with only so much £ in their pocket. Their limited beer cash might get them 4 pints of bitter or 3 two-third glasses of modern-IPA. Either way your business needs its target cut of their precious limited £… and in the above numbers a freehouse will make £7.24 out of the £12.80 worth of bitter and £6.36 out of the £12 worth of modern-IPA. (In the graphic below we’ve assumed the lowest brewery duty rate, but it isn’t really going to make a lot of difference which rate is involved.)

So, at £6 per-pint the pub has just given you a discount on some pretty lush IPA.

That’s GP for you. And why you really cannot think a £60 firkin of 3.6% brown bitter ought to sell for a very similar per-pint price as a £95 keg of 5.4% hoppy modern IPA.

Check my working… hopefully I’ve got all the above correct. Here’s the spreadsheet to go with this post.

Whether the keg of modern hoppy IPA ought to be £95 is a trickier debate… but that’s the price and your choice is to have that beer at that price, or some other beer at a lower price. My experience of “cheap” keg IPAs so far has not been excellent, but there is some good stuff on the market at prices down to around £85 I think. Below that it mostly starts to get a bit suspect.