Captain’s log, additional…

@YeastieBoys remarked that it is worth noting the impact of excise (duty) on the cost of beer. A definite factor, and one to be aware of – even if it is unlikely to change and thus a bit futile to worry about too much. But definitely worth having a good grump about from time to time…

@beeryvan brilliant Yvan. I know you’re not focussing on the brewery end here but excise has a massive impact on the final price…

— Yeastie Boys (@yeastieboys) May 23, 2015

In the UK at the moment the full rate of duty is £18.37 per-hectolitre-%… (a hectolitre is 100 litres, or 176 pints) i.e. on a hectolitre of 5% beer you’d pay £91.85 in duty. But only if you’re a “big brewer” – one that brews 60,000 hectolitres or more. A “small brewer” who brews no more than 5000 hectolitres pays half the duty rate. And there is a “progressive” rate between these two sizes. This is due to the progressive-beer-duty scheme which is intended to give start-up breweries a boost to counter the economies-of-scale unlocked by being bigger. (There is debate over whether or not this discount is right, too much, or too little…) I’ve illustrated the progressive beer duty scale previously.

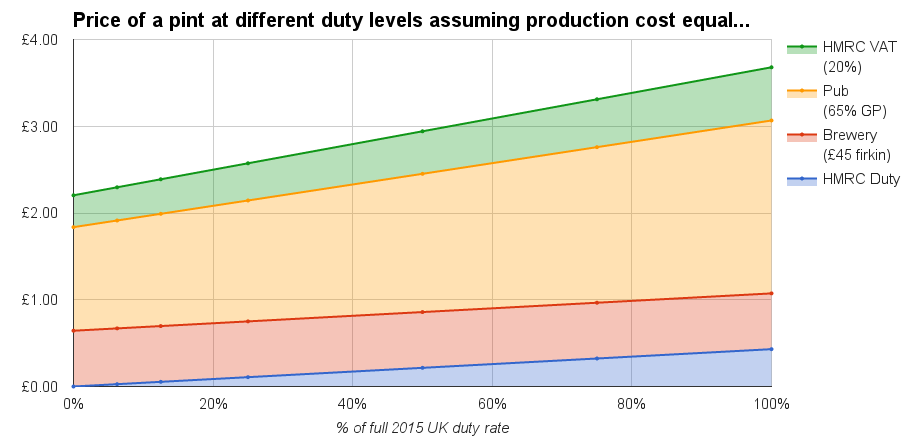

At the end of the day duty is a part of the production cost of beer. Breweries pay it and factor it into their price. Then pubs calculate their GP on this price, typically as a %, then VAT is added also as a %. So duty gets amplified such that it can have a significant impact on final price.

Regardless of the price of a firkin of beer (ignoring economies of scale) the difference between half duty rate and full after amplification by a typical 65% GP* and 20% VAT is always 74p on the cost of you pint. (The reality is that large breweries economies of scale allow them to sell firkins at the same price as small breweries so this difference hits the brewery books but not the consumer.) And between a zero duty rate and the current full duty rate the difference in price is amplified such that the difference to the consumer can be seen as a whopping £1.48… £1.96 at no-duty versus £3.43 at full-duty. I.e. £1.48 of your 4% ABV pint from a big brewery is added purely as a result of duty.

So if duty was scrapped entirely we could probably enjoy more than a quid off the price of a pint. Wouldn’t that be nice!

It isn’t so simple of course – if the taxman had to lose the huge pile of £ made out of the duty and amplified VAT he’d have to tax us in other ways. Perhaps more equitible ways though? Do we really think the cost of alcohol to society is equal to the amount of £ raised by the level to which it is taxed? (I really don’t know – the beer industry would likely say ‘no’, but the schmucks at ‘alcohol concern’ probably think it needs even higher taxation!)

I expect I’d personally be in favour of scrapping or massively scaling-back beer duty and increasing VAT to 25%… but I’ve done no sums to support the total economic impact of such a change. This is just wild, and probably pointless, speculation at this point.

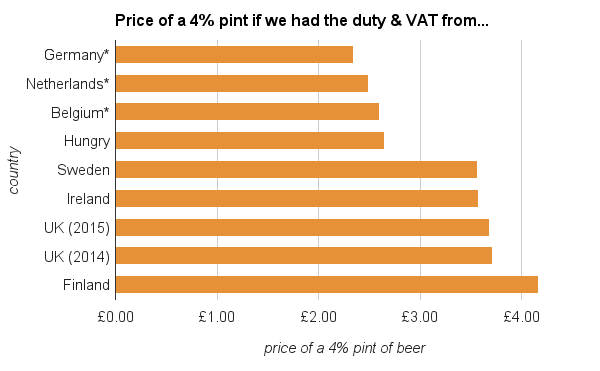

It is worth noting that across the EU beer duty varies… the UK is one of the highest.

There is very detailed comparative information in a PDF right here, this is from 2014 and is the pre-reduction rate of UK duty. Here’s a quick summary of how my £45-quid firkin would fare in a few different countries – all other things being equal. This is making all manner of assumptions… also I’m totally unsure of my translation of the German/etc hectolitre-degree-Plato duty to a roughly equivalent UK hectolitre-% rate. Think of it more as: were taxes from <country> applied within the UK context:

I’ve included both the pre-2015-budget “penny off a pint” rate and the current UK rate. At 4% it really is about a penny off a pint, which is then amplified to 3 pennies by VAT & GP. Woohooo…

So… there you go. Google tells me the average price of a pint in Germany is £2.12 so the above seems not too far off. Time to move to Germany!

* typical 65% GP – I say this as my observation here in Cambridgeshire. Across the country this varies. Rents and wages are higher in Cambridge than, say, Hull – so where I pay £3.50 for a pint of a given type of beer I know some folk up north are paying £3.00 or even less. All the numbers above scale with the change in GP. If you want to play here’s the spreadsheet.

Again: Basic accounting theory tells us that GP should never be measured as a %. No wonder 30 pubs are shutting every week if they can’t even manage basic accounting practices.