“Ich habe Pläne große Pläne” – Rammstein, Stein um Stein

No no, wrong take on “gross” – this is definitely not about making an obscene amount of profit… I’m writing about “gross profit” as in “GP” – a term often heard when industry folk are talking about beer prices. I have written about GP before, with a focus on the role of the distributor in pricing – in this post I focus more on the pub and the beer. The motivation comes from recently having had £4.50 pints of Beavertown Gamma Ray being compared to £3.00 pints of £60-per-firkin bitter as if the Beavertown ought to be closer to the £3.00. As it stands £4.50 for a pint of Gamma Ray is near unheard of as that is pretty heavily discounted for promotional purposes.

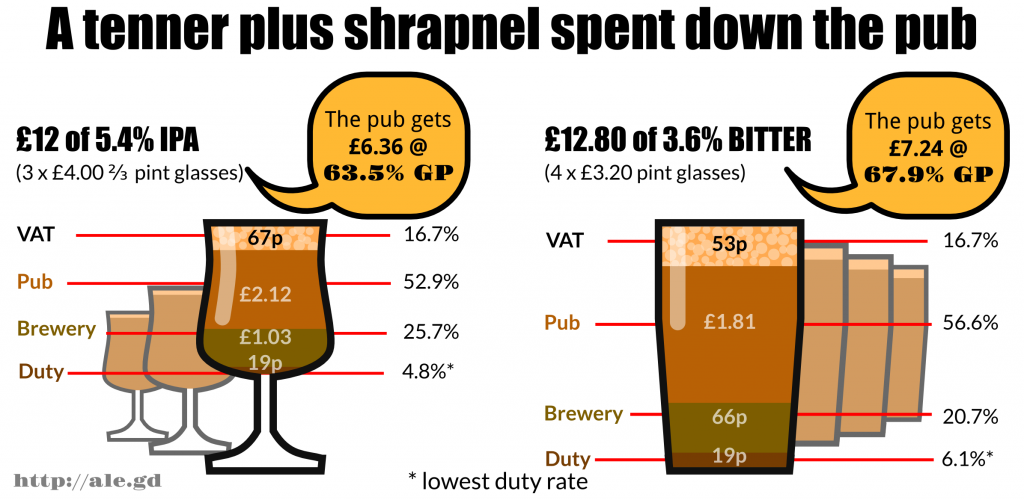

GP is the “gross profit” made on goods sold. That is the margin made by the business in ex-VAT terms. If I sell pints of beer for a bargain £3.20 per pint I have a revenue of£2.67 per pint once the 20% VAT is scraped off. If that pint comes from a cask that costs me £60 (about normal for a local “boring brown bitter”) then each pint is costing me 86p (assuming a 70 pint yield per cask). So my gross profit on a pint is about £1.81… typically GP is expressed as percentage – this is the percentage the gross profit is of the revenue and in this case is 67.9%. This would be considered “pretty healthy” by most pubs.

When pubs talk GP they’re generally speaking of the average for the beer they sell. They’ll be targeting some specific figure that suits their overall business plan. This can be anything from as low as 40% in a countryside tied pub that probably survives only on profits from non-drinks sales to 70% in a city-slicker freehouse which might get away with being pretty much “wet-led” (most income is based on drinks). Two extremes of the pub spectrum.

All business situations are different – tie, location, rent, staff costs, etc. There’s a good breakdown of the costs of running various sorts of pubs available from the BBPA. There isn’t a one-size-fits all when it comes to GP. Yet customer expectations set a pretty narrow band for acceptable pricing of a pint, a trend now being a little broken out of by the “craft beer” scene. Still – a tied pub next door to a freehouse can hardly sell equivalent beer for a quid more per pint than the freehouse… so it typically makes a significantly lower GP on beer.

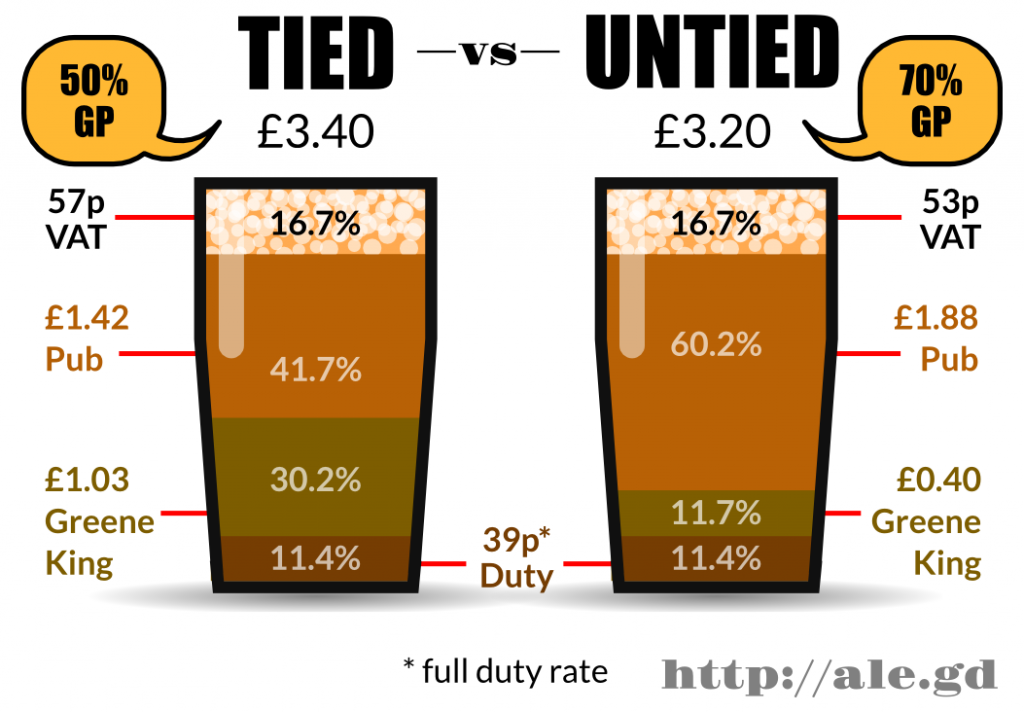

Let us look at a well known brown bitter as an example, a “20th century IPA” style of thing at about 3.6%. I’m talking about Greene King IPA of course. This is available on the open market at pretty low prices, I’ve heard of pricing as low as £55 from one reliable source. Meanwhile I know one Greene King landlord who pays £99. These prices are all ex-VAT, as is the way of these things. The problem is both pubs have to sell this beer for about the same price… in Cambridge let us say this is £3.20 in the freehouse and £3.40 in the Greene King place. The Greene King place isn’t going over the top on the price and there are plenty of drinkers in Cambridge who won’t be at all fussed by 20p if the pub is otherwise pretty good.

The freehouse GP here is a very healthy 70.5%… but the poor old Greene King pub is only at 50%. Keep in mind that these are pretty much extremes and there is a range between them, and then things differ again per beer and per pub.

The GP as a % versus “margin” in £ is important because punters generally only go out with so much £ in their pocket. Most people are living within a finite budget when it comes to luxuries like having a pint. The freehouse is making more per average customer. If the tied pub want to achieve similar profits it has to sell more volume (be larger, be in a better location) and/or shift other products – i.e. turn into a gastropub. Or maybe it can get by just fine as a wet-led pub simply making less profit… like I said before, every business situation is unique.

So that’s GP – and GP compared for tied and untied pubs. Now I get to the next core point of this blog-post: what does this mean for “craft beer” and why does my pint of Beavertown Gamma Ray cost me six bloody quid?!

Great tasty beer costs more. I won’t try to explain why – there are plenty of debates about how reasonably, or not, it is priced. All I’ll say is the brewers I know brewing what I think of as awesome craft beer are mostly working at capacity and expanding. Textbook supply-vs-demand means they can command a higher price for their product – within reason. Flavour is a factor, ingredients, and quality – but big factors are also fashion and brand… the best have all of these right. These folk haven’t founded a brewery with the aim of competing in the lowest-common-denominator end of the market. If this craft beer also happens to be in keg it’ll cost even more per pint, another debate to be had (and has been had) elsewhere.

In my opinion Beavertown stuff is reasonably priced, in the grand scheme of mid-5%s kegged craft beers. A pub will be typically paying anything between £85 and £100 for 30 litres of this lush 5.4% beer – depending on location, volume, and supply chain. For some calculations below we’ll pick £95 for a 1-off keg purchase in a very craft-keg-rotation-happy bar. This is to compare to the same bar buying any one of a dozen mid-3%s local bitters at £60 for a firkin.

We’ll say you get 52 pints out of a Gamma Ray keg, so a pint is costing £1.83 – more even than the pint of *tied* Greene King IPA (£1.42). But at £6 per pint the GP the pub is making on this beer is 63.5%. Most freehouse crafty places I know are aiming for the 65-70% GP range. They’ll cut a bit from target GP selling Gamma Ray at around £6 but balance this out by selling a “craft lager” at £4.50-£5.00 and higher GP (in the 70-75% range).

But, the punter says, a 70% GP pub selling a 3.6% 20th-century-IPA (brown bitter) is only making £1.88 from my pint – but this craft beer bar is making £3.18 from my 5.4% new-wave IPA… the profiteering SCUM! Fuck’em!

It doesn’t work like that. Going back to my point of punters with only so much £ in their pocket. Their limited beer cash might get them 4 pints of bitter or 3 two-third glasses of modern-IPA. Either way your business needs its target cut of their precious limited £… and in the above numbers a freehouse will make £7.24 out of the £12.80 worth of bitter and £6.36 out of the £12 worth of modern-IPA. (In the graphic below we’ve assumed the lowest brewery duty rate, but it isn’t really going to make a lot of difference which rate is involved.)

So, at £6 per-pint the pub has just given you a discount on some pretty lush IPA.

That’s GP for you. And why you really cannot think a £60 firkin of 3.6% brown bitter ought to sell for a very similar per-pint price as a £95 keg of 5.4% hoppy modern IPA.

Check my working… hopefully I’ve got all the above correct. Here’s the spreadsheet to go with this post.

Whether the keg of modern hoppy IPA ought to be £95 is a trickier debate… but that’s the price and your choice is to have that beer at that price, or some other beer at a lower price. My experience of “cheap” keg IPAs so far has not been excellent, but there is some good stuff on the market at prices down to around £85 I think. Below that it mostly starts to get a bit suspect.

Pingback: The impact of duty/excise on the price of a pint | ALE.is.GooD

Brilliant we need more of this in beer retail

.Every time I hear folks in the trade talk about gp I weap. For flips sake put away your gcse marketing theory and use some common sense (or even economics) . Aim isnt to maximise gp but actual hard profit . I dont go to the pub with 20 quid planning to spend it all, I go with 20 planning on 3 pints and hoping to come home with close to s tenner change. Sell me gamma ray at 6 quid I’ll be honest ill have a half but I’m already making plans to switch pubs. Sell me gamma ray at 4.50 I’ll happily do 3 pints (doesnt take much maths to work out which scenario makes more actual profit) . I see chains completely obsessed with gp totally forgetting their different site opperate in different markets with different fixed costs (eg rent ) this results in bars in cheaper suburbs being told to sell at same prices as those in pricy city centre locations. Oh and please who pays 3.40 for gk? My local has it on at 2.25 and I walk straight past.

Also worth adding: *you* might not drink £4 two-third measures of Gamma… you’re probably simply not the target market. I expect you probably think those who drink it are mugs. But from practical experience and observation many people neck this stuff like crazy, so there are enough mugs. Hell – *I* a one of them and have been for years. And pubs that sell it for this sort of price buy and re-buy it, and it’s one of the few products I shift that pubs buy in multiples rather than the odd guest keg here and there. (Gamma and Neck Oil.)

Must be working for some…

so you’re saying not only shouldn’t I be shocked at paying 6.80 for a pint of Gamma Ray in Kentish Town, but some crappy beer is being marked up to subsidize my lovely Gamma Ray?

Pretty much. Depends on how much you believe in the religion of %GP of course.

(Sorry, for business reasons it’s been over a year since I even logged into this old blog… :-/ busy busy.)

Hi Steve, I’m not meaning to put GP forward as an object/concept of worship.

GP is just a measure. Different pubs target different GPs… there’s rarely a quest to “maximise GP” (in the sense of “how much can we fleece our customers for”) – more one of “what GP do we need to function well as a business and make a decent enough profit to actually make it worth the shittonnes of work required to run a pub. For the most part your market determines where this GP ends up… as you state, the cost of a pint is likely to dictate how likely customers are to drink in your pub and how much they’ll drink. The ideal is to find a “sweet spot” that makes everyone happy… decent vol of beer shifted per line, happy drinkers, and hopefully a viable income.

Yes, folk running a business are pretty focused on GP and that’s why we talk about it a lot. GP levels really do make or break your ability to operate successfully. Pubs are a pretty well modelled business type (as is distrib) so there’s a lot of material and experience in the industry that is centred on where GP ought to lie. (As per the linked-to BBPA material.)

Can you locate me many pubs that sell Gamma Ray (or equiv) at 4.50? I was selling it at 4.50 for an event… and it wasn’t enough really. But the event was semi-promotional thus the “cheap” price. In future at a similar event I’d probably not bother with the Gamma… but if it was a very high vol event then sure, it’d probably work and even at that price.

I know one pub doing Gamma for 3.50 right now :) As of earlier this week, and only until the keg runs out… but that’s a pretty unusual case, and also a debtless outright ownership micropub… (It’s my local, the Bank in Willingham). They simply charge all keg products at 3.50… obs making a lot less on a keg of Gamma than on a keg of Adnams lager. He doesn’t know his GP (his accountant most likely does of course) and probably doesn’t care what it is as in his simple business model and personal situation it isn’t as pressing as for folk who’ve a huge monthly rent and wage bill. I keep telling him he’s selling it too cheap, but don’t press this too hard as it’s kind of in my own interests for my local to sell awesome beer really cheap ;)

As for Greene King IPA… it is certainly mostly above 3 quid in these parts. I’m in the Cambridge area and pints of anything below 3 quid are rare, at least in the pubs I visit. Typical 20C IPA like GKIPA, Wherry, etc, is 3.20+… There’s a Wetherspoons in Cambridge of course, I’m sure they’re selling GKIPA for something like 1.99.

Interesting post however I think there may be a small error in the GK diagram. If the duty is 39p in both cases then in the second case it should be 12.18% as a percent of the gross selling price (39/320).

You are quite correct. Oops. I shall get my graphics department on it… as soon as she’s got a spare moment :)

It would be interesting to do a similar comparison between say Beavertown Neck Oil or Camden Town Pale Ale and a premium cask ale such as Timothy Taylor Landlord or Oakham Citra. I don’t work in the trade but I believe both of these cask ales tend to sell at a premium to a lot of others.

I can understand the price premium between Gamma Ray and GK IPA and drink both in different situations but I’m not so convinced of the virtues of the two keg beers that I’ve mentioned above against the two cask ale examples. I would only really drink those two particular keg beers when a decent cask alternative wasn’t available.

Sure, I’ve gone with close to extreme opposites within the realm of UK beers that folk might drink multiple glasses of here. Actually because the real-life motivation for this post did come from a guy comparing £4.50 pints of Gamma Ray to £3 pints of £60-per-firk bitter… feeling he was being ripped off on the Gamma.

A cask of TT Landlord will cost most folk in my area around £99 (£1.41 p/p) – so I gather, and so I’ve seen listed. Same for London Pride. Oakham deliver directly here, are known for high prices, but I’m not sure how high. Publicans think most things prices are “high prices”. Many I know will stock Landlord or Pride but price higher to mitigate the cost – many others simply won’t stock them. Both beers do have the advantage that they tend to shift well thanks to their reputation. For a “craft beer”* around 4% in cask via a distrib like me £99 would really be pushing it… £90 tops except in exceptional cases.

Camden Pale is known to be pretty “reasonable” on price, but I don’t have any firm numbers on that. This will narrow the cost gap, maybe even flip it. But I don’t have confident enough numbers to provide details.

Neck Oil will generally cost my customers about £85 for 30l (~52 pints – £1.63 p/p). A good hoppy 4.3% pale ale in cask will cost them about the same for approx 41 litres (I call it 70 pints servable – £1.21 p/p).

Generally beers being at a similar price for either 30l-keg/9g-cask is pretty normal (i.e. per pint the same beer in 30l keg is notably more).

* By “craft beer” I sort of mean mean “good” beer from a brewery that wouldn’t be considered national/mainstream. I don’t intend to make any statement or put forward a definition – more reflect the practical reality of the beer market as observed by myself. A “craft beer” is that which the buying public/publicans calls a “craft beer”.

Any pub that calculates GP as a % fully deserves to go bust for incompetence, avarice, or both. Its faulty cost accounting.

Not really sure how to respond to this. GP can be expressed as a % and is. Industry-wide. As a measure of operating a pub it is used by economists and accountants widely & ubiquitously. I am neither an accountant or economist so can only work based upon the analysis of my betters in that department.

Which is what I am telling you: its extremely poor accounting practice as it almost inevitably leads to pricing irregularities – such as sub-optimally priced pints that undermine demand in both the short and long run.

Obviously a lot of pub owners don’t know much about accounting or economics (hence the reason 30 pubs go bust every week), but presenting this incompetent accounting as some kind of standard accepted practice is really not helpful.

I don’t know what your expertise is to dictate that what seems (to me) to be standard operating practice is “extremely poor accounting practice”… you don’t work in the beer industry you stated? Perhaps you are an accountant or some form of economist… fine, you’re more qualified than I – although I’ve claimed no qualifications, only that I am describing observed/actual practice. I also do not try to justify how it all works… so welcome any useful explanation as to how it could be better. Of course that might require something along the lines of a 10k word research paper I suppose.

The modern pub industry is, I gather, pretty well understood & analysed, across thousands of pubs and decades of time. Use of “GP” to measure business and set pricing is standard. Even more so at the larger corporate level than at the indy pub level – i.e. at levels where they have accountants and economists on staff.

Many pubs aim for a general ballpark GP outcome. They’ll balance GPs across products in order to try and “sanitise” prices. Thus in my example the bit of a “GP discount” on Beavertown… some may have the power to balance this more strongly if they can (and are willing to) buy in really cheap beer. But I doubt you’ll find many willing to discount Gamma Ray down to £4.50 per pint.

As for the general GP target – location is of course quite important too… cost of living in London, and places like Cambridge, mean pubs require a much higher GP outcome than many up north.

Generally I agree, and I would hope everyone would, that actual ‘P’ is the key result. GP is just a tool/measurement used in achieving this. Usually forced on us by folks like accountants.

I am totally all for doing things differently, and “shaking up” an industry… for what it is worth. So if there is an intriguing alternative to standard practice then I’d probably be all for giving it a go when/if I have a bar. But balanced against the fact that such as business is risking _my_ time and money, my livelihood, and the jobs and pay of the staff it employs. There would need to be an incredibly sound business case for taking the risk.

For what it is worth I also frequently find myself suggesting to pubs that they target a lower GP on certain lines in order to drive higher volume sales of what are incredibly popular products in some cases.

But I’m just a guy who sells beer… in many cases these are folk who’ve been in their trade for years, if not decades, and in some cases parts of pub chains/investment-vehicles driven by folk who’ve a track record of extremely good business success.

I always doubt my own mind on things. And am always learning and willing to learn.

GP is a flexible tool – it can direct pricing, it can analyse performance, it can in some cases simply rule out the viability of products for your business, or give you a point of negotiation with a supplier. (The last being one where see the sharp end of a pointy GP stick pointed at me from fairly often.)

“Generally I agree, and I would hope everyone would, that actual ‘P’ is the key result. GP is just a tool/measurement used in achieving this”

But that’s the point – GP is something you measure in retrospect, not something you can actively set like its some kind of adjustable profit control. The relationship between GP per pint and total GP is not a straightforward relationship. Quite often putting up the former will drastically reduce the latter.

If you want a quick and dirty formula, then setting prices to maximise

hourly sales volume * (price-cost) – hourly overheads.

is a much better method than setting an arbitrarily high % mark-up and then wondering why the bar is so quiet.

But pubs _do_ use GP to set their pricing – with some “fuzz factor” & balancing, as I’ve explained previously.

Also my post is pretty clearly positioned to explain how pub pricing works to punters, as I observe it in most pubs. The aim it not to tell folks who run pubs how to run their businesses.

The pubs I sell to are mostly visibly popular & successful and AFAIK all use target GP to guide their pricing. They are not wondering why their bar is so quiet – and they do not set an arbitrarily high GP, they take pains at trying to find a GP point that works for them and their customers.

Its clearly more of a prescriptive than descriptive post. The title is not “how confusion over basic accounting principles mean that pubs charge £6 for some pints and £3 per others” but instead “why £6 is a good price for a pint of Gamma Ray”.

“But pubs _do_ use GP to set their pricing ” I know. But as I’ve explained, it really is an incredibly stupid and economically illiterate thing to do. No competent accountant would ever recommend such a ridiculous idea.

You could sit and watch the bar at the Cambridge Blue for hours and not see a single person order a craft keg. Its a waste of pump space, frankly. And no wonder – some of them are £3.50 a half. Who in Cambridge is rich enough and stupid enough is going to pay that?

Sure, it is why _I_ think £6 is a fair price – given the information to hand which is described within the post. Describing how pub pricing generally works to folks who drink in them, but certainly not describing to pubs how they should work. It is entirely about describing GP to folks. The fact that GP is what is used is a fact, not a thing I am prescribing.

If this practice is “an incredibly stupid and economically illiterate thing to do” then I suggest you get in touch with folks like Greene King’s pub management wing same for Martson’s, etc. And explain the alternatives to their accountants. Of course pubs from both of them don’t generally seem all that healthy sometimes so that may not be such a useful example from my side of the argument. (I’d argue it is because many of such pubs are generally not great, and has little to do with their pricing – which is usually of the lower sort anyway.)

So how about the craftier bars and pubs like the one you mention – the Cambridge Blue… they don’t seem to be going too badly business-wise… do they? (The Blue folks have 3 pubs now, and a 4th on the way. ) Chains like the ‘Tap’ places and Craft Beer Co seem pretty healthy. Yet I think most of these tend to stick to the same general principles. If they could do phenomenally better than they are by being less incredibly stupid and economically illiterate then I suggest you let them know – if cheaper beer prices will result in their increased success then everybody ought to come out of that extremely happy.

The Blue seems to go through their kegs, are happy with the range, including the more expensive imports, and do continue to buy these beers from both myself and others. There are clearly enough people in Cambridge “stupid” enough to pay these prices, and I guess there are many more stupid people who’re keeping places like the Pint Shop going from strength to strength. I am one such stupid person, albeit very rarely do I have either the time or funds for town drinking. I am not rich, but I don’t go to the pub to down pint after pint – I go to enjoy myself and enjoy some beer. This generally means drinking more expensive beer in generally more expensive bars. I’ve wasted enough of my limited cash on shit beer in my life. I come at this first and foremost, and came to this industry first and foremost, as a beer drinker and enthusiast.

Also the stuff over £7 per pint at places like the Blue tends to be either 7.5%+ on the ABV scale or imported, in the case of my NZ stuff shipped from the opposite side of the planet in a giant fridge. So the kegs cost a fair bit. The importing is worth it from my PoV, presumably not yours, it isn’t meant to be a font of everyday quaffing beer though.

Pubs taking imports and high strength/craziness beers almost always scale back their GP on them – pretty much all of them do. They scale back as far as they dare.

I remain unconvinced.

A really interesting read. As an accountant, I’d say that using this kind of metric is of course a valid way to help make pricing decisions and understand the profit potential of different products. I actually found the above examples a little hard to follow but I think we’re on the same page. A pub would need to decide what target GP% it needs to aim for to be a successful business, which I think would be heavily influenced by the demand in the market it operates in and the overhead cost base that the pub needs to cover.

Taking your two extreme examples I think what it boils down to is that the pub needs to know what the demand looks like – how much it can sell at what price. A pub selling only the expensive craft beer will need to sell a much lower volume of high cash margin beer than the tied pub selling cheaper beer at a lower cash margin. This is completely fair as ultimately it’s the customer who will decide whether they want to spend their finite money on a few expensive beers or many cheaper ones. There’s no right or wrong answer when it comes to margin %, the requirement of the landlord therefore is to understand the customers to decide which strategy will be most profitable!

AB actually has a point when he says “you could sit and watch the bar and not see a single person order a craft keg.” because it is so expensive. Absolutely right, and if the landlord has any common sense he will know this and might even be ok with it, because he will have set the price so that he doesn’t have to sell as much in order to make a respectable profit. Craft beer doesn’t have to be a volume game, if there is demand at the higher prices that enable landlords to make a margin then everybody is happy.

yeah, but there’s not. There’s huge demand for cask beer at £3.50 and there WOULD be huge demand for keg beer at £4.00. But if the pub is charging £6 a pint, then they wouldn’t know this.

The Cambridge Blue lives on food and cask beer. If it relied on craft keg sales it would go bust within a week.

Ever wondered why give years after craft beer hit the mainstream, we can still basically name every craft beer pub in the UK? Its because the insanely greedy pricing structure is unwittingly restricting what could be a massive sector into a tiny niche market.

Meanwhile, brewdog continue to sell their beer at a £4.00 price point and make millions.

I do actually see what you’re getting at. But I am not convinced the “greedy” pubs can (or should) charge much less for these beers, nor that they are comparable to BrewDog. Not that I know the profit/loss/viability of the BrewDog bars. A BrewDog in Cambridge would be welcome from my PoV (I like what they do to some extent, plus I’ll be able to make use of my shareholder discount more than twice a year), and might put that little bit of pressure on to push the general keg prices down a bit.

I’ve certainly never claimed the microbrewery keg stuff was significant part of the Blue’s business. They like being able to have those beers on, they like providing them to the small part of the market who enjoy them, they don’t try to rip folks off IMO.

OTOH there’s the Pint Shop, who don’t balance out the keg stuff with oodles of cheaper cask. Albeit I don’t know what their keg/cask vol split is.

Tiny niche market – yes. And I expect “craft” will always be a small market. Like premium wine is. Like most premium things are. Most folk simply seem to prefer bland stuff at a cheapish price – which is why brewers who want to do more exciting beer are migrating towards the emerging keg market that allows them to make a suitable profit on better beer. [And no, not everything calling itself “craft” is super exciting, there’s plenty that is either dull or actually bad.] All a bit hand-wavy at this point admittedly.

I did a sort of a vague business-plan/numbers on opening a bar that structured pricing based on a general cost-to-serve + reasonable profit. It would be good for the keg stuff, for certain. But there wasn’t a good way to do it without bringing the currently pretty subsidised cask beer prices up to balance things. Advice was that it wasn’t a great idea :) But hey, it might be worth a try… but I think it’d have to be done in a keg-only bar. Or perhaps an entirely remodelled “concept”. I can’t afford to open a bar alas!

I think its unimaginative to think that craft beer is only ever going to be a niche market. Its currently a niche market product because its being held back by its excessive pricing. But those firms that have experimented with slightly more sensible prices have experienced huge growth and the biggest profits. You’d think that would tell people something, but apparently not…

“Most folk simply seem to prefer bland stuff at a cheapish price ”

I don’t think that’s true at all. Many, many people would prefer to drink craft keg, they’re just not willing to pay £2 extra for it.

As an accounting exercise, if you got the Blue to sit down and calculate an absorption costing calculation on a pump by pump basis, I bet they’d find they were actually making a significant loss on their craft keg lines.

Every time I go in the Pint Shop, people seem to be drinking either the wine, the lager, or the cask ale. Mainly the wine.

As a distributer Yvan, you should be encouraging lower retail prices to increase your sales turnover and hence increase your own GP!.

I let my pessimism leak out far too often. I think “craft beer” (“interesting beer”) is a definite growth market – and I think it has long-term potential, even if there is a bubble burst or two along the way. I choose to align myself with those most likely to survive any bursts… I think. On grounds of reputation and product quality – not to mention good old “ability to execute”.

I do encourage lower retail prices to some extent. But it isn’t my place to advise pubs how to run their businesses. For the market, the product, and myself as a distributor and drinker lower retail prices are great. My GP is not a fixed % (whilst I do have a target), and it is quite low on the fancy stuff. Volume is absolutely key for me.

This is all interesting food for thought.

Interesting accounting comments. The question a marketing man would ask is this: “Would you rather have 1000 customers all coming in once per month or 250 customers coming in once a week?

The answer is the former. While a base of loyal customers is important it’s far better to spread you risk across many, many occasional passing customers. And if you set your prices too high then passing trade will dry up.

The craft boom / bubble WILL burst and some of the trendy types will move back to cider, cocktails, wine. Whatever the next big thing is. Then the craft pricing will not be sustainable.

Poster above has it correct. Brewdog are absolutely nailing it. But they know they are a CPG / FMCG company and are aiming to reach as many customers through as many channels as possible. The clever bit is the marketing to the core “Equity Punks” which is their way of ensuring the core customer keeps a decent proportion of all their beer spend with them.

A pub would do well to follow this model, but I fear it needs the scale of a chain to become economically viable.

So, basically we need a Craft Wetherspoons. :) ‘spoons have edged in that direction a little, but their scale is perhaps actually too large for the scale of the “craft” side of the industry to service. There is no need for the best in the scene to deeply discount for the likes of ‘spoons, they’re all too small and seemingly always operating at capacity. I think as well as the collective buying power of a chain on one side the craft brewing side needs to be in a position to offer beer at lower prices to large contracts. (They do already to some extent, of course, but there’s a huge gap between what ‘spoons pay for cask and what even the largest customers pay for “craft” cask and keg.)

Someone expanding nationally, such as the Tap “chain”, combined with a procurement and distribution hub.

All bubbles burst, all things die, but do you think it’s 5 years away or 5 decades? Currently the bubble is a very small one I think. (The microbrewery-boom OTOH worries me somewhat, UK breweries-per-head looking a bit OTT. Few of these new breweries are doing more than producing some cheap and pretty normal, not necessarily _bad_, cask.)

Now I shall daydream of Jolly Good Bars… poppin’ up all over the country like some kind of pox… cheap and cheerful craft beer :)

Who knows when the bubble WILL burst?

One thing is certain, the market for premium product is not big enough for more than a few players and price pressure will be downwards to meet demand.

I can see micropubs with low overheads forming chains or joint buying agreements long term.